Investment Outlook – Trend 1 , Published Mar 14, 2017

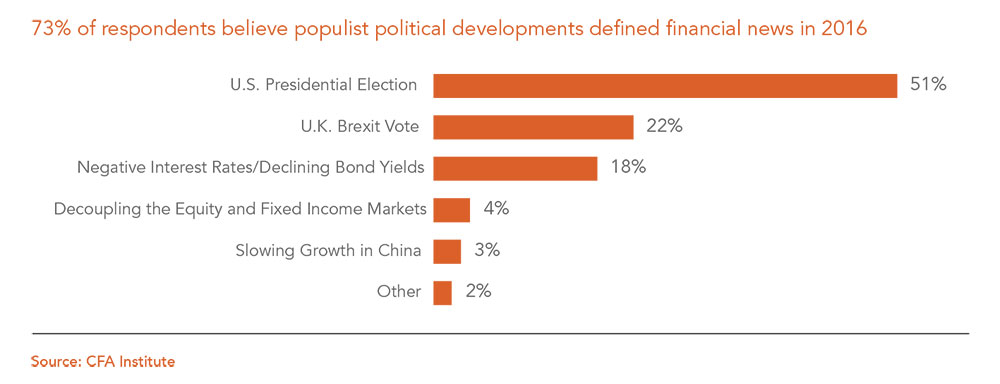

Markets were positioned for gridlock. Congress was expected to be split. Regardless of who won, the White House was expected to face a political stalemate and nothing significant would get done. But that is not how it played out. Republicans gained control of the Executive, Legislative and Judicial branches of the U.S. Government. This was the scenario nobody expected.

The sound of the Trumpet was heard around the world.

Throw Out the Old Playbook, New Rules Apply…

Mr. Trump defeated Jeb Bush in the primaries, Hillary Clinton in the general election and put to bed the dominant Clinton / Bush machine that has been overseeing U.S. politics for the past 28 years. Expect trends that have worked over the past to no longer hold true going forward. Some examples we would put forth would be a pivoting in strategic relationships with China, Germany and Russia, rising trade protectionism, rising nationalism, a re-think on globalism and the very concept of the West.

Mr. Trump’s Three Step Economic Agenda

Mr. Trump has a three step economic agenda:

This will not be easy.

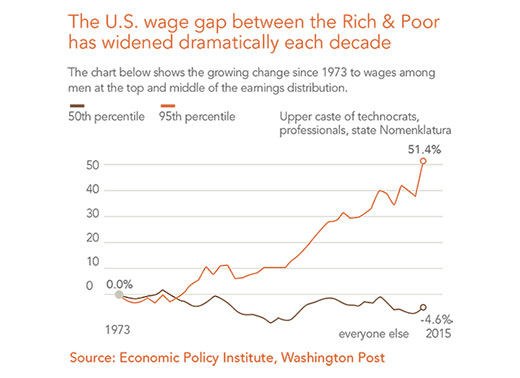

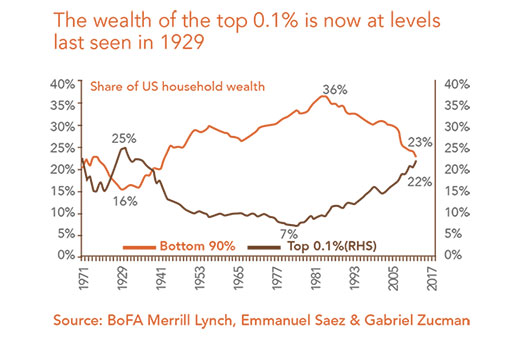

What Mr. Trump inherits though, is not pretty. The average American has seen his wages decline since 1973, while the wage growth of the wealthy has been astronomical. The top 0.1% are about to overtake the bottom 90% in household wealth, which last happened in the 1920s.

The U.S. has already peaked on its dependency ratio. 94 million people have dropped out or are no longer in the workforce. The oldest Baby boomer first born in 1946, is now 70 and the youngest is 52 years old. As the Baby Boomers retire, the U.S. is going to feel a rise in the burden that this class puts on the economy.

Trump the Saviour?

Global markets have been on a tear since Trump won the election. Mr. Trump is now widely perceived as the saviour. His cabinet selections lend further credence to a corporate and business friendly regime. Markets are buying into the hope rally of fiscal stimulus trumping QE flows, but we would argue that Mr. Trump does not have a magic wand. He is fighting the headwinds of rising interest rates, an ageing demographic, a hawkish Fed, a weakened consumer, a stagnant banking system, a strong dollar and rising commodity prices.

An Emerging World Order

During the campaign, Mr. Trump heaped criticism on America’s senseless wars in the Middle East. He and his supporters want the U.S. to abandon its global leadership role and retreat from the world.

Trump’s presidency will be highly disruptive to the American foreign policy. Trump will stick firmly to his pledge to Make America great again. His slogan of “Buy American, Hire American” and recent pulling out of the Trans-Pacific Partnership free trade negotiations highlight the protectionist intent.

A U.S. that moves toward isolationist nationalism will remain the world’s most powerful country by a wide margin; but it will no longer guarantee Western countries’ security. If Trump defers to Putin in the Middle East, Europe is far too weak and divided to stand in for the U.S. strategically. Thus, the Western world, as virtually everyone alive today has known it, will change dramatically.

What comes next? China, we can be certain, is preparing to fill America’s shoes in Asia, while in Europe, the move towards nationalism has begun.

Download ReportInvestment Outlook 2017